Blog

Stay up to date in the industry.

Automating a Prop Firm: How to Operate at Scale with Fewer Resources

The Case for Automation in Prop Trading Proprietary trading firms face intense competition and...

From Startup to Global Prop Firm: Scaling Up Without Losing Control

Scaling Challenges in the Prop Firm Journey Launching a prop trading startup is one thing, scaling...

iFX EXPO International 2025 – Recap: Catch the Excitement and Highlights

From June 17–19, Axcera attended the iFX EXPO International 2025 in Limassol, Cyprus, where...

Axcera and Solitics Partner to Advance Prop Trading Automation

Axcera, a leading prop trading technology provider, announces a strategic partnership with...

The Future of Prop Trading: Trends Driving Prop Firms Forward

Proprietary trading (“prop trading”) is evolving at a rapid pace. What started as a niche avenue...

Safeguarding a Prop Trading Firm: Modern Risk Management and Fraud Detection

The Evolving Risk Landscape in Prop Trading Operating a prop trading firm involves unique risks....

Axcera at iFX EXPO 2025: A Conversation That Matters

From 17 to 19 June 2025, Axcera will be on-site at iFX EXPO International at City of Dreams...

How to Start a White Label Prop Firm With Full Control

In the evolving landscape of proprietary trading, speed to market is critical, but maintaining...

Axcera Appoints Lubomir Marasi as Commercial Director to Strengthen Commercial Strategy and Market Growth

Axcera is entering a new phase of growth. To support our expansion into new markets and deepen our...

Axcera May 2025 Release: Smarter Automation. Sharper Controls. Clearer Visibility.

This month’s release reflects our focus: helping firms operate with greater precision, less...

Celebrating one year of strategic partnership: Axcera and cTrader powering modern prop trading firms

Celebrating one year of strategic partnership: cTrader and Axcera powering modern prop trading...

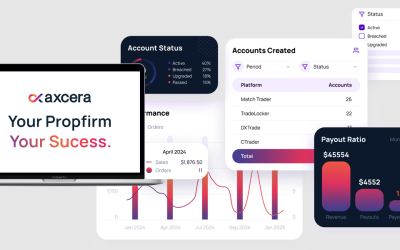

Introducing Axcera’s Hybrid Model: The Future of Prop Firms!

In the evolving world of proprietary trading, operational efficiency and scalability are no longer...

Axcera April Release.Smarter tools, smoother experience.

In April, we launched updates to make our platform easier to use. These changes improve...

Axcera March 2025 Updates: Faster Workflows & More Control

March was an important month for Axcera, highlighting our continued focus on innovation and...

The Future of Prop Firms is Here

The proprietary trading (prop trading) industry is undergoing significant transformation, and...

Axcera x iledgends: Helping Prop Firms Access the Right Banking Solutions

Prop firms need more than just technology. Axcera and iledgends make it easier to access the right...

Axcera’s February 2025 Updates: More Control, Faster Payouts, and Smarter Operations

As we close out February 2025, we’re excited to share the latest updates that prop trading firms...

Starting A Prop Trading Firm

Ever wanted to start a prop trading firm but did not know where to start? Here is a simple guide for what to do, what technology you need and how to stand out.

Axcera at iFX EXPO Dubai 2025: Event Recap and Key Takeaways

The iFX EXPO Dubai 2025, held on January 15-16, brought together leading brokers, prop trading...

2024: End-Of-Year Reflections

The end of a year and the start of a new one is always an excellent time to press pause and...

How Risky Is Starting A Proprietary Trading Firm?

A prop firm will use its own technology, strategies and capital to trade, all of which come with inherent risks, but is that much worse than investment funds?

How Do Proprietary Trading Firms Make Money?

A lot of small and medium-sized investment firms swear by proprietary trading as the way in which they make their returns, but how do prop firms make money?

How Do You Set Up A Proprietary Trading Firm?

Proprietary trading is an opportunity to take advantage of innovative investment strategies using your capital to maximise potential gains. How do you start?

November Tech Updates for Prop Trading Firms

November Updates: Axcera’s Latest Tech Updates November has been an exciting month for both the...

What Was The Legacy Of The Nifty Fifty For Proprietary Firms?

Financial markets are so unique and multi-faceted that there are multiple strategies available to prop firms, but this started through the failure of the norm.

How To Create A Prop Firm

If you are interested in the Forex market and have been involved as a trader, you might feel your...

Why Is Prop Trading Still Shaped By Ancient Technology?

Given that the stock market can shift rapidly on a moment-to-moment basis, advanced prop firm...

Exactly How Far Has Prop Firm Tech Advanced?

The history of prop firm technology is not the same thing as the history of prop firms. This is...

What Features Are Needed In Futures Prop Firm Software?

Investing is, by definition, a forward-thinking industry. Traders do not buy assets, whether they...

When Should You Not Start A Proprietary Trading Business?

One of the key tenets of due diligence in financial trading is not just finding reasons to invest...

Learning From Failure: Lesson For Prop Firm Success

If you are thinking of starting a prop trading firm, you will be in good company. Many companies...

Who Invented Automated Trading Before Financial Technology?

Whilst there are a lot of ways to invest effectively, success as a proprietary trading firm will...

How Did The Financial Big Bang Affect Prop Firm Technology?

Technology is a critical component of any functioning financial market, and the most successful...

How Can Prop Firms Handle Major Market-Shaking Events?

This year has been one when electoral events have created plenty of uncertainty that could have...

Does Your Prop Firm Need A Technology Upgrade?

Most companies nowadays use modern digital technology in some way or another, even when they...

How Can Prop Firm Tech Handle Political Uncertainty?

There are many times when money markets and stock markets are rocked by sudden, unexpected events....

How To Start Up Your Own Prop Firm

The Forex trading sector has always been important, but it has inevitably changed over time,...

How Did A Green Screen Terminal Change Financial Trading?

One of the most beautiful elements of being a proprietary trading firm is the fact that thanks to...

Is Now A Good Time To Set Up A Prop Firm?

Many factors can determine whether a new business will be successful or not, but it is not always...

How Can Prop Firm Tech Help You Act Fast In Trading?

Setting up a prop firm can be an exciting prospect. With some talented traders on board, you can...

What Did We Learn From LSE’s Failed Electronic Trading Technology?

The modern world of electronic trading platforms, prop firm software and a diverse range of...

How Can Prop Firm Technology Help In A Market Crisis?

The idea that a prop firm could manage in the modern stock market without the best technology is...

How Technology Can Increase Prop Firm Success

Technology plays a huge part in every aspect of business these days, so it is not surprising that...

How Has Prop Trading Technology Evolved Over The Years?

There are more options to set up a prop trading firm now than ever before, with wider access to...

How Does Software Help With Risk Management?

The most successful trading operations are not the ones that take the fewest risks, but the ones...

The Most Unusual Piece Of Stock Trading Software Ever

Setting up a prop trading firm requires a lot of ingredients to succeed, including the right...

How The First Electronic Trading Platform Changed Everything

Financial markets are amongst the most advanced and fast-moving drivers of technology in the...

What Was The First-Ever Online Stock Market?

Modern prop firm trading is heavily reliant on the adoption of advanced trading software in almost...

Is Starting A Prop Trading Firm The Right Business For You?

If there was a single word to describe a proprietary trading firm, that one word would be...