Industry news, Insights and more

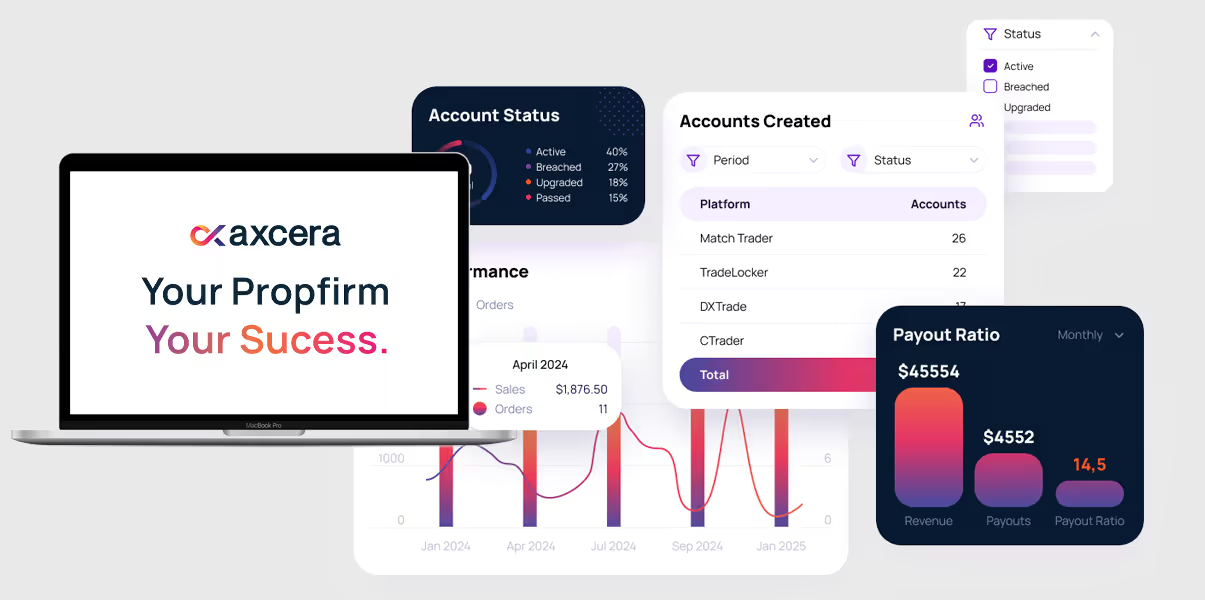

Enterprise-grade infrastructure for modern prop firms. Accelerate operations, reduce costs, and scale with certainty.

Blog Articles

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

No items found.

Ready to Start your Prop Firm?

Join 50+ satisfied prop firms powered by our enterprise-grade technology

Exceptional 24/7 Support

Forex & CFD Ready

Multi-Platform Integrations

Enterprise-Grade Security

Real-Time Oversight

Advanced Analytics & Reports

%20(1).jpg)

%20(1).jpg)

.avif)